Today is the 17th anniversary of the Bitcoin white paper, which Satoshi Nakamoto published on October 31, 2008. At that time, few could have imagined Bitcoin would one day fundamentally changed how we think about money, trust, and the internet.

This anniversary made me reflective, and I dug up a university report I wrote back in 2017. It was my academic attempt to summarize the white paper and evaluate the Bitcoin ecosystem as it stood eight years ago. Reading it again today, I see I was heavily focused on the technical pros (like its decentralized nature) and what I saw as very real 2017 cons: the 51% attack risk, privacy issues, and the “long time delay” for transactions.

Standing here in 2025, it’s a fascinating and humbling experience to see what that 2017 analysis got right, and what I completely missed.

2025 Retrospective: What I Got Right #

Standing in 2025, looking back at that 2017 report, it is a fascinating (and humbling) experience.

The Technology Over the Asset #

My central and most important prediction was: “The most significant meaning of Bitcoin system is the Blockchain technology behind”. From the vantage point of 2025, this is undeniably correct. The innovation explosion of the past eight years, from the “DeFi summer” of 2020 to the NFT boom and the rise of DAOs, all happened on the blockchain application layers (like Ethereum, which I noted as Blockchain 2.0), not on Bitcoin itself.

The Inevitability of Regulation #

I worried that Bitcoin’s anonymous features, which provided “a loophole for criminal activities such as money laundering or blackmail”, would become a serious problem. I throught this would lead to “national governments wanting to regulate even cancel it”. This is exactly what has happened. “Regulation” has been the single biggest theme of the 2020s, with governments worldwide implementing strict KYC/AML frameworks, debating stablecoin laws, and defining the legal status of digital assets.

Shaking the Financial System #

I claimed that the “Bitcoin system shakes the current finance system”. In 2017, this was a bold statement. By 2025, it’s an established fact. We have witnessed the approval of spot Bitcoin ETFs on major stock exchanges, the adoption of Bitcoin as legal tender by sovereign nations, and the inclusion of crypto-assets on the balance sheets of major corporations.

Identifying the Core Technical Challenges #

My report correctly pinpointed the key challenges the industry would spend years trying to solve. I flagged “Volatility” and the “long time delay” for payment verification. Volatility remains a defining feature. And the “long time delay” (scalability problem) became the primary catalyst for the entire Layer 2 industry, such as Lightning Network and ZK-Rollups.

2025 Retrospective: The Blind Spots #

The Direction of Commercial Applications #

This was my biggest miss. My report ended by “looking forward to more commercial applications”. However, my 2017 vision of “Blockchain 3.0” was entirely focused on enterprise-level BaaS (Blockchain as a Service) platforms. I specifically cited Microsoft Bletchley and IBM Bluemix as the future.

In 2025, it’s clear the real “killer apps” did not come from these permissioned, corporate environments. The revolution came from permissionless, decentralized applications (DApps) built by a global community of developers. I was looking for the future in the wrong place. It wasn’t in corporate boardrooms, but in open-source protocols.

The Evolution of Consensus #

My report was fixated on Proof-of-Work (PoW) and its associated risks, like the “51% Attack”. I failed to anticipate the massive industry pivot to Proof-of-Stake (PoS). In 2022, Ethereum’s “Merge” changed the game on energy consumption and scalability. Back in 2017, I didn’t see that coming at all.

The Solution to Scalability #

While I correctly identified the “long time delay” as a major con, I presented it as a fundamental flaw. I couldn’t predict the success of Layer 2 solutions. In 2025, the 10-minute block time of Bitcoin is almost irrelevant for daily users who transact instantly on the Lightning Network. I saw the problem but had no vision for the solution.

It’s humbling to see how fast this space moves. My 2017 report was a decent summary of the 2008 white paper, but the world it described so outdated from 2025. Re-reading that 2017 report is a powerful reminder that the challenges of one era become the breakthrough innovations of the next.

The Snapshot of My Original 2017 Report:

Bitcoin White Paper Review: Principles, Evaluation, and the Blockchain Ecosystem

#

#

Abstract #

Bitcoin is a peer-to-peer electronic cash system base on Blockchain technology[1]. This report summarizes the main ideas of Bitcoin based on Satoshi Nakamoto’s Bitcoin white paper that was released in 2008, and discusses the positive and negative points of this system. Related work and further progress are also presented in this report.

Index Terms—Bitcoin, Blockchain, Ethereum, BaaS

I. Introduction #

Bitcoin currency is a peer-to-peer version of electronic cash[1]. It is not issued by any specific currency institution; instead, it is generated by specific algorithmic calculations. The currency system uses a peer-to-peer network to confirm and record all transactions. Asymmetric cryptography ensures that bitcoins can only be transferred or paid by the real owners, which ensures their anonymity and security. Decentralization and algorithms ensure that people cannot generate a large number of bitcoins. The total quantity of Bitcoin is limited to 21 million, giving it strong scarcity. Bitcoin can also be converted into the currencies of many countries, allowing people to use it to buy real-world items.

The remainder of the paper is structured as follows. In Section II, We give a brief overview of the background and origins of Bitcoin. In the subsequent Section III, we introduce its technical details such as principles, algorithms and features. Section IV discusses the pros and cons, as well as related work based on Bitcoin blockchain technology. Finally, we present the current status and outlook in Section V.

II. Background #

Our current cash system consists of banks, online payment systems such as PayPal and Alipay, and different kinds of operators. The availability of the current system depends on the third party that we have to trust. This trust-based system causes plenty of inconveniences.

A better solution is a system that cannot be controlled by anyone and cannot be reversed. Compared with existing systems, the new system is based on cryptographic proof instead of trust. Bitcoin was introduced as a decentralized payment network. The concept was presented for the first time by Satoshi Nakamoto in 2008.

III. Approach #

Basically, Bitcoin runs in peer-to-peer network, The core philosophy is to trust no one but yourself, which involves:

- Running your own peer

- Validating all transactions

- Calculating state locally

Principles #

Bitcoin defines an electronic coin as a chain of digital signatures[1]. Each owner transfers the coin by sign a hash of the previous transaction and the public key of the next owner, and adding these to the end of the coin, as Figure 1 shows.

Timestamps ensure there is no double-spending[1]. As shown in Figure 2, each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

To implement a distributed timestamp server on a peer-to-peer basis, a proof-of-work mechanism is used:

- All nodes try to solve a hard problem.

- The solution is easy to verify.

- The first node to find a solution writes a block and includes the solution.

- Other nodes verify the solution and accept the block.

The difficulty of proof-of-work increases with the difficulty of the whole system.

The process for the Bitcoin network is as follows: first, new transactions are broadcast to all nodes. Each node gets the information and works on calculating the proof-of-work for its block. The first successful node broadcasts its block to all nodes. The other nodes verify this block and accept it if it is correct. Then, all nodes work on creating the next block, using the hash of the accepted block as the previous hash[1].

Incentive #

In the Bitcoin system, there are two types of incentives:

First, the block creation reward. Besides providing an incentive for nodes to support the network, this reward provides a way to initially distribute coins into circulation, since there is no central authority.

Second, transaction fees. Figure 3 shows a sample transaction. In transaction C, .005 BTC is taken from an address in Transaction A, and .003 BTC is taken from an address in Transaction B. For the outputs, .003 BTC are directed to the first address and .004 BTC are directed to the second address. The leftover .001 BTC goes to the miner of the block as a fee. This incentive structure can transition entirely to transaction fees and become completely inflation-free[1].

These incentives may help encourage nodes to stay honest since it is more profitable to play by the rules[1]. In the Bitcoin system, disk dpace can be reclaimed by hashing transactions in a Merkle Tree, with only the root included in the block’s hash. Old blocks can then be compacted by stubbing off branches of the tree. The interior hashes do not need to be stored[1].

To simplify payment verification, a user only needs to keep a copy of the block headers of the longest proof-of-work chain and does not need to run a full network node[1].

IV. Evaluation #

Pros and Cons #

Bitcoin system has many advantages compared to existing solutions:

- It is a fully distributed system; no third party can control it.

- The network is robust in its unstructured simplicity. Nodes work all at once with little coordination[1].

- Nodes can leave and rejoin anytime, needing only to accept the existing proof-of-work blockchains.

- It is difficult to attack since transactions are transparent and the system is decentralized.

- The system is secure and anonymous. Asymmetric cryptography ensures that people cannot fake the signature. ∙ Timestamps ensures there is no double-spending.

At the same time, the Bitcoin system also has obvious drawbacks.

- PoW strategy has the risk of a 51% Attack, which is the ability of someone controlling a majority of the network hash rate to revise transaction history and prevent new transactions from confirming[13].

- Since everything on the chain is public and transactions are transparent, Bitcoin may have privacy issues.

- Payment verification has a long time delay. Each block takes an average of 10 minutes to be generated. Compared with existing methods, Bitcoin needs much more time to confirm a transaction.

- An account can be stolen, password can be lost, or hardware can be damaged. In these situations, no one can help since there is no third party.

Since this paper is a review of the Bitcoin white paper, it is not meaningful to judge the pros and cons of the white paper itself.

Blockchain Ecosystem as Related Work #

The most significant aspect of the Bitcoin system is the blockchain technology behind it.

Blockchain is a shared, public, distributed Ledger, which is composed of linked blocks containing transactions with an immutable history, determined by community consensus and over which no single party has control.

As Figure 4 shows, the basic blockchain technology, Blockchain 1.0, is a simple state machine that focuses only on the transaction. The most famous application is Bitcoin, whose details we have already discussed.

In 2015, a revolutionary improvement was made by the Ethereum project. It created a logic tier for the blockchain to provide vast possibilities. Each node acts as a stakeholder inside the chain to excute logic and transactions.

Ethereum is a blockchain with a programming language. Compared with Bitcoin, Ethereum has added a logic tier in the form of smart contracts, which are compiled and deployed to the blockchain, existing alongside the data in the database.

Users can write smart contracts to create their own rules for ownership, transaction formats and state transition functions. Smart Contracts are excuted by the Ethereum Virtual Machine (EVM), which can execute code of arbitrary algorithmic complexity[4]. Solidity is a new language for smart contracts. It is a contract-oriented, high-level language whose syntax is similar to that of JavaScript, and it is designed to target the Ethereum Virtual Machine[5]. It is statically typed, supports inheritance, libraries and complex user-defined types, among other features. Figure 5 shows the basic architecture of Ethereum.

Ethereum led to a new distributed architecture and later involved into BaaS (Blockchain as a Service). Compared with previous blockchain systems, BaaS platforms provide external accessibility to the blockchain logic, which makes the blockchain a foundation on which to build distributed applications. Microsoft Bletchley and IBM Bluemix are the most famous BaaS platforms.

Microsoft Bletchley is an Enterprise Consortium Blockchain Ecosystem[7]. It is an open, modular blockchain fabric powered by Azure but not a new blockchain stack. Bletchley uses a distributed ledger as its protocol. Currently, Ethereum is one of the most important protocols supported by Bletchley V1. At the same time, Microsoft has partnerships with other blockchain service providers such as Ripple, Eris, Coinprism and Factom. These blockchain services will also be in Bletchley as part of their future plan. Compared with Blockchain 2.0, it has an additional “Cryptlet Fabric” tier can be thought of as Blockchain 3.0, which secures the interoperation and communication. The blockchain middleware of Bletchley provides core services functioning in the Azure cloud[8]. Figure 6 shows the architecture of Bletchley.

![Figure 6: Bletchley architecture[14]](https://blogpic.orbqiao.com/251031bitcoin/6.jpg)

IBM also has a similar BaaS platform called Bluemix. The core protocol in Bluemix is Hyperledger. IBM uses Hyperledger Fabric with IBM Blockchain on DockerHub to provide blockchain services in other environments such as third-party platforms or localhost. This aims to realize functions similar to cryptlets and improve off-chain security and scalability.

V. Current Status and Outlook #

This paper was published in 2008. Bitcoin now has detailed documentation, tutorials, different use cases and many communities. As of 6th August 2017, one bitcoin equaled $3292.76[10]. Due to the Bitcoin algorithm, the total number of blocks is limited to 21 million. At the time, the block count was 479392[15], and blocks continue to be added to the end of the chain at an average rate of one every 10 minutes[11]. Around 2140, there will be no new bitcoins.

The Bitcoin system is shaking the current financal system. In this sense, besides the technology itself, it has other characteristics. The positive sides are: payment freedom, the ability to choose your own fees, fewer risks for merchants, and security and control. The negative sides are: a low degree of acceptance, volatility, and ongoing development challenges[2].

Furthermore, the anonymous feature of Bitcoin holds a great attraction for some specific groups, such as the people from crisis countries. It even provides a loophole for criminal activities such as money laundering or blackmail. These have become serious problems, and national governments want to regulate or even ban it.

In my opinion, the most significant aspect of the Bitcoin system is the blockchain technology behind it. The blockchain ecosystem continues to grow with new techniques. Blockchain is a very hot topic nowadays, and its future looks bright. We look forward to seeing more commercial applications based on these blockchain ecosystems.

Reference #

[1] Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008

[2] Bitcoin offical website: http://www.bitcoin.org

[3] Bitcoins the hard way: Using the raw Bitcoin protocol:

http://www.righto.com/2014/02/bitcoins-hard-way-using-raw-bitcoin.html

[4] Ethereum project: https://www.ethereum.org/

[5] Solidity: https://solidity.readthedocs.io/en/develop/

[6] Ethereum white paper: https://github.com/ethereum/wiki/wiki/White-Paper

[7] Microsoft BaaS: https://azure.microsoft.com/en-us/solutions/blockchain

[8] Bletchley whitepaper: https://github.com/Azure/azure-blockchain-projects/blob/master/bletchley/bletchley-whitepaper.md

[9] IBM: https://console.bluemix.net/catalog/services/blockchain

[10] Coindesk: https://www.coindesk.com/price/

[11] Bitcoin Wiki maintained by the Bitcoin community: https://en.bitcoin.it/wiki/Block

[12] This figure comes from: http://www.righto.com/2014/02/bitcoins-hard-way-using-raw-bitcoin.html

[13] This definition from: https://bitcoin.org/en/glossary/51-percent-attack

[14] The figure comes from Bletchley whitepa-per: https://github.com/Azure/azure-blockchain-projects/blob/master/bletchley/bletchley-whitepaper.md

[15] This number comes from: https://blockexplorer.com/api/status?q=getBlockCount

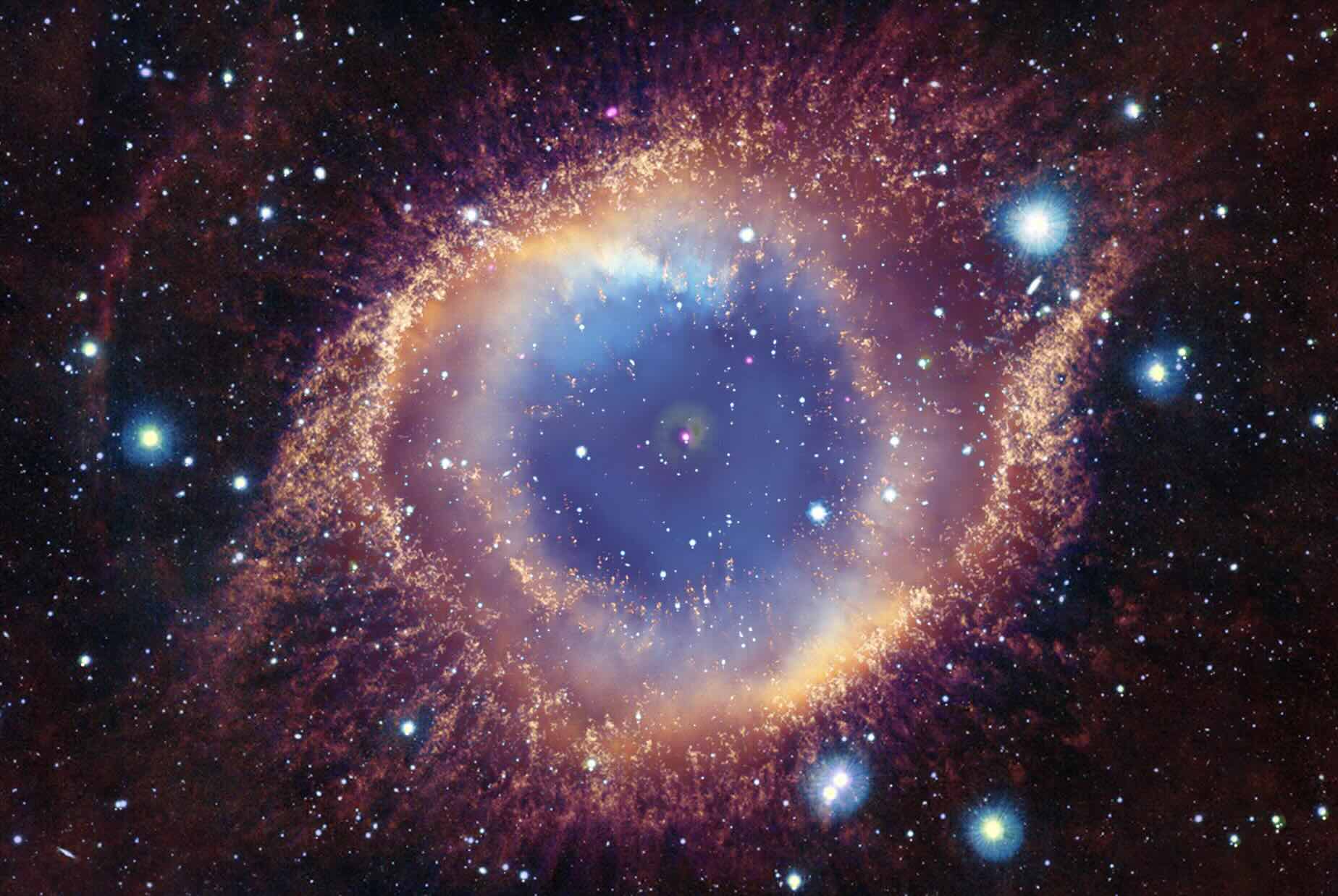

Cover image: These end stages of a star’s life can be utterly beautiful – as is the case with this planetary nebula called the Helix Nebula. Astronomers study these objects by looking at all kinds of light. From NASA