Continuously updated

AMM #

Automated Market Maker

A DEX protocol that relies on mathematical formulas to price assets, rather than an order book.

Call/Put Options #

Financial contracts giving the right to buy (Call) or sell (Put) an asset at a set price.

CeFi / DeFi #

Centralized Finance / Decentralized Finance

CeFi: Financial services run by centralized companies (like Binance or Coinbase), similar to traditional banks.

DeFi: Financial services built on public blockchains utilizing smart contracts, without intermediaries.

CEX / DEX #

Centralized Exchange / Decentralized Exchange

CEX: An off-chain program for buying, selling, trading, or swapping on-chain assets.

DEX: A peer-to-peer marketplace where transactions occur directly between crypto traders.

Concentrated Liquidity #

A mechanism (popularized by Uniswap V3) where LPs allocate capital within a specific price range to increase capital efficiency.

FDV #

Fully Diluted Valuation

Price × Total Supply (including locked tokens). The theoretical value once all tokens are unlocked.

GameFi #

The intersection of blockchain gaming and DeFi, where players can earn value through gameplay.

Grant #

Non-repayable funds provided by a foundation or DAO to developers to build on their ecosystem.

KYC #

Know Your Customer

Identify verification process used by financial institutions to prevent fraud and money laundering.

LSD / LST #

Liquid Staking Derivative/Token

A token representing staked assets that can still be traded or used in DeFi while the underlying asset earns rewards.

Locking / Soft Locking #

Locking: Freezing assets in a contract for a period.

Soft Locking: Incentivizing users to keep assets staked without strictly enforcing a hard lock period.

LP #

Liquidity Provider

Users who deposit assets into a pool to facilitate trading on a DEX, earning fees in return.

LP Token #

Liquidity Provider Token

Often refers to the token receipt users get when they provide liquidity, representing their share of the pool.

Maker #

A trader who places limit orders that add liquidity to the order book.

Market Cap #

Market Capitalization

Market Cap = Price × Circulating Supply. Reflects the current market value and rank.

Market Maker #

Professional entities or algorithms that actively quote buy and sell prices to ensure market liquidity.

MEV #

Maximal Extractable Value

Value extracted by miners/validators by reordering, including, or censoring transactions in a block.

NFT #

Non-Fungible Token

Unique digital assets verified on a blockchain, distinct from interchangeable tokens like Bitcoin.

P2E #

Play-to-Earn

A business model in blockchain games where players earn crypto or NFTs that have real-world value through gameplay.

Perpetual Futures #

A derivative contract similar to futures but without an expiration date.

Prediction Market #

Markets where users trade on the outcome of future events.

Quadratic Funding #

A funding matching mechanism where smaller contributions from many people are matched with larger amounts from a pool.

RWAs #

Real World Assets

Tokenized versions of tangible assets like real estate, gold, or bonds on the blockchain.

Slippage #

The difference between the expected price and the actual execution price.

Stablecoin #

A cryptocurrency pegged to a stable asset like the US Dollar to minimize volatility.

Staking #

Locking up crypto assets to support the operation of a blockchain network in exchange for rewards.

Synthetic Asset #

Tokenized derivatives that mimic the value and price fluctuations of another asset (real-world or crypto) without requiring ownership of the underlying asset.

Taker #

A trader who accepts existing orders on the book, removing liquidity.

Tokenomics #

The economic model of a token, including supply, distribution, utility, and incentives.

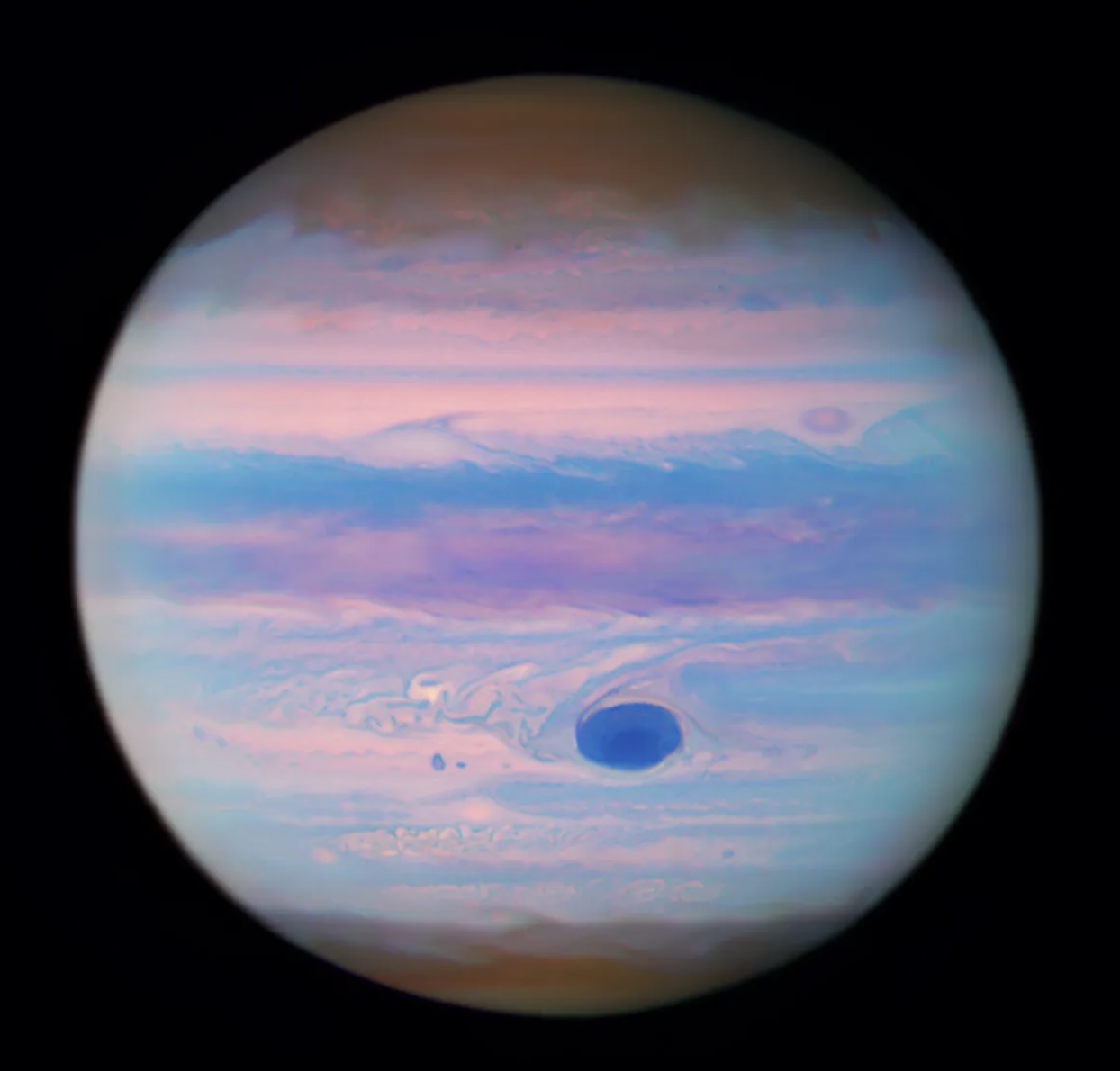

Cover image: This NASA Hubble Space Telescope image shows the planet Jupiter in a color composite of ultraviolet wavelengths. From NASA